Synopsis & working document to bundle some HOA insurance issues.

FUN FACT: In 2021 we spent $11000 on HOA insurance!

Both in 21 and 22 we’ve had some claims. The most common issue seems to be where HOA commons insurance overlaps with the jurisdiction of individual homeowners insurance.

’21 Claims

200 building (individual household claim) water damage from broken hot water heater – awarded

200 building (individual household claim) water damage from ice dam on roof – awarded

’22 Claims

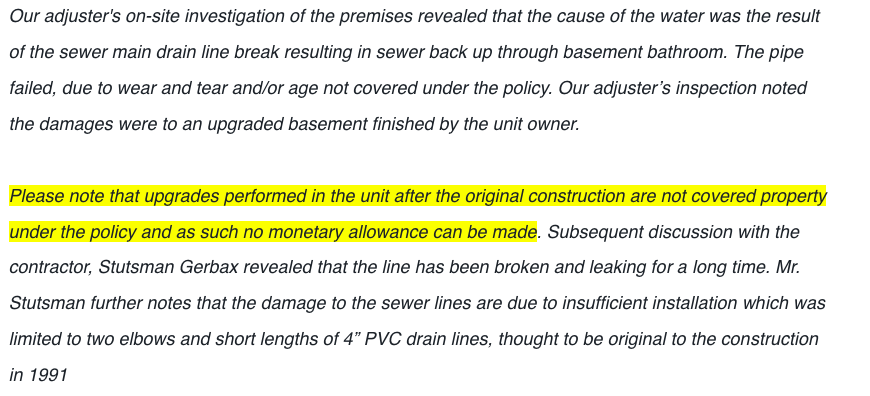

300 building (common HOA claim) sewer break – pending

300 building (individual household claim) water/sewer damage – denied

300 building (individual household claim) Mold – denied/ disputed

?What is the HOA’s policy of meeting homeowners’ expenses when a claim is (partially) denied

1 HOA Insurance

2 Homeowners insurance

3 HOA –

?Claim denied due to insufficient installation can we update policy in coverage.

Polo will look into updating insurance policy

?Does the policy need to be updated to cover capital improvements (upgrades performed after the original construction

?Bundle streamline all individual home owners individual coverage

?What is the flow chart of claims and restitution of those, who handles/ ? property manager.

HERE GOES THE LINK TO THE PDF POLICY

Insurance Agent: Mountain West

Contact: stefanh@mtnwest.com

Phone:

Policy Nr:

CAU: Policy nr